In this show I talk about 15 Financial Myths that I have heard repeatedly over the years. Buying into these myths could derail your finances and prevent a financial legacy. Here they are:

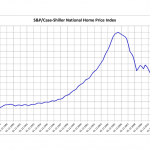

1) A house is a great investment because it always goes up in value

See Chart

The gauge is down ab out 35% from its peak before the housing bubble burst in 2006

out 35% from its peak before the housing bubble burst in 2006

2) This is a risk free investment

3) Bonds are safer than stocks

4) You need life insurance your whole life

5) Life insurance is a good way to save for college tax free

6) Term life insurance is like renting, it is throwing away your money

7) Buy and Hold portfolio is the best investment strategy

8) If you dollar cost average you don’t need to worry about fluctuations in the market

9) If I had 1,000,000 dollars I would be set for life

10) Money isn’t very important

11) Gold is a good/lousy investment

See article An ounce of gold can buy about what an ounce of gold bought 100 years ago.

12) All 10 year periods in the stock market have made money

Dave Ramsey on his article

1906-1924 18 years had a -4.29% cumulative return

1929-1953 25 years had a 1.69% cumulative return

1965-1981 17 years had a .83% cumulative return

2001-2010 10 year depending on what month you start and end on had a best return of 2.66% and a worst of -2.28% cumulative returns

13) You can never loose your money in an annuity

14) I need a job with benefits

15) Debt can be good if it is used right